The

Pareto Principle

The Pareto Principle states that, for many phenomena, 20% of

invested input is responsible for 80% of the results obtained.

In Vilfredo Pareto's case, he used the rule to explain how 80% of property in

Italy was owned by 20% of the country's population.

This principle serves as a general reminder that the relationship between inputs

and outputs is not balanced.

For example, the efforts of 20% of a corporation's staff could drive 80% of the

firm's profits.

In terms of personal time management, 80% of our work-related output could come

from only 20% of our time at work.

It is also interesting to note that in trading, the market ranges about 80% of

the time. In other words, during 20% of the time when the market trends can

we expect to generate higher profits from our trades.

To put this into perspective, there can only be 4 outcomes from each of our

executed trades:

1. Small Win

2. Small Loss

3. Large Win

4. Large Loss

Cases 1 and 2: small wins and small losses arose from ranging markets most of

the time.

Case 3: Large wins can be achieved during a trending market to take advantage of

the big moves.

Case 4: Large Losses can be contained like Case 2 with proper stop loss settings.

If you are a manual trader, you may want to save 80% of your time for not

trading during a ranging market given the relatively smaller returns.

Alternatively, you can have your profitable range trading strategies automated,

so that you won't miss out on most of the trading opportunities when the market

is not trending.

"The 80/20 principle – that 80 percent of result flow from just 20 per cent of

the causes – is the one true principle of highly effective people." - Richard

Koch.

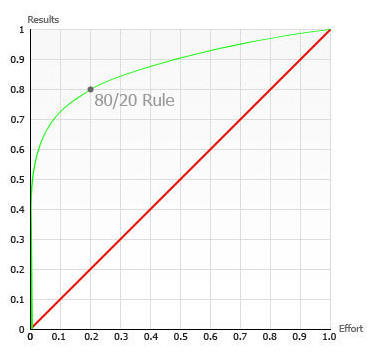

The 80-20 rule displayed as a graph (green line). If all effort

yielded equal results, the red line would be valid.

The essence of 80-20 rule is that things are not distributed equally. Each unit

of work does not contribute to the same amount. In the perfect world, every

employee would contribute the same, every bug be equally important, every

feature equally loved, and planning would be simple.

In trading, the effort you make and the frequency you trade are

not relevant, only profits are.

It's a fact that traders who trade discriminatorily and are patient, make more

money than traders who simply trade the noise and the action.

If you trade less, you can afford to risk more with the trades that have the

odds on their sides which are more likely to be successful.

By acting on the axiom that most of the results in any situation

are determined by a small number of causes, this 80/20 rule will enrich your

life in all areas.

The Pareto Principle is also prevalent in the churches.

It is not uncommon for pastors and leaders to devote 80% of their attention to

problems and complaints of the 20% minority at the expense of the majority.

While these problems and complaints need to be addressed, they should not be

allowed to set the agenda and to dominate

the bulk of their time and attention.

The Great Commission which is the reason for the existence of

the Church is much more than just attending to problems and complaints in

the churches.

The Pareto Principle would be most effective if we can

apply 80%of our time and efforts to the most significant 20% of our tasks that

need to be accomplished.

The 90 10 Principle