|

A profitable trader will practice his uncomplicated system

so as to build confidence before trading with his real money.

He accepts that loosing is part of the game and

knows that profits are just around the corner, and he does not switch to

another system.

With good money management, he will always keep losses small

when he is wrong and leave the profits running

when he is right. |

|

Capital preservation is the key

to survival in trading. IMO, the best approach to profitable trading is

partial profit takings.

A bird in hand is worth two or more in the bush. It's better to gain small but

real advantages than the possibility of a greater one.

Cutting your losses is as important as letting your profits run.

Automated trading helps made this a reality for me. |

|

Based on the assumption that the

market gives a 50/50 win/loss (ignoring the spread) and a risk/reward ratio of

1:2, it is incorrect to assume that you will get a 50% chance of winning twice

the amount for each loss you made over the long run.

The reason is that it is easier for the price to hit your stop loss and twice

harder for it to reach your take profit with the risk/reward ratio of 1:2.

Partial

profit taking is the steadier way to capital

preservation and let the remaining positions to

ride the trend to greater profitability.

Partial

exit strategy is not easy to implement manually but is a breeze with automated

trading. |

|

If

you can cut your losses to the minimum without hesitation and let your profits

run consistently, you can never lose with any trading strategy that gives you

an edge in your trading.

Many traders make the mistake of trying to perfect their trade entries when

they should pay more attention to devising and sticking to an effective exit

strategy and prudent money management. |

|

The Forex market is too complex

to allow the prediction of price movement with 100% certainty.

However, the probability for the market to continue its directional movement

is higher than a sudden change in its direction.

The trend is your friend until it bends.

Traders can take advantage of this universal law of momentum together with

proper money management to increase their odds of winning from the market. |

|

We know from experience that

it's going to rain when we see dark clouds and hear thunders. The same logic

applies to the study of price patterns in predicting price direction.

Since the meteorologists rely on high tech to forecast the

weather,

shouldn't the traders do the same to predict market direction?

Trading robots can be programmed to recognize market trend and to trade

objectively based on price formation. Automation will free the traders the

chore of monitoring the market and allow them to spend more quality time with

their loved ones. |

|

Entering the trade just after a

price retracement will minimize a loss when the entry is wrong or will

maximize a gain when the entry is correct.

Buy low and sell high is the only way to profitable trading.

Automated trading has given me the speed advantage to have my open and close

orders accepted at the best possible prices. |

|

There should be 2 parts to any

trade entry.

The first is the entry setup that provides us with a

high probability of a winning trade.

The second is the trigger which tells us when is the

best time to enter our trade.

Precise entries (trigger) is more critical with shorter term day trading than

just getting the overall direction (setup) correct

with swing trading or position trading. |

| Technical indicators should never be used alone for the triggering of your

trade.

The reason is that all indicators are lagging since their computations are

based on historical prices.

Trade entry based on price pullback together with trade setup confirmation

based on technical indicators and price pattern will give traders a better

than average chance of success. |

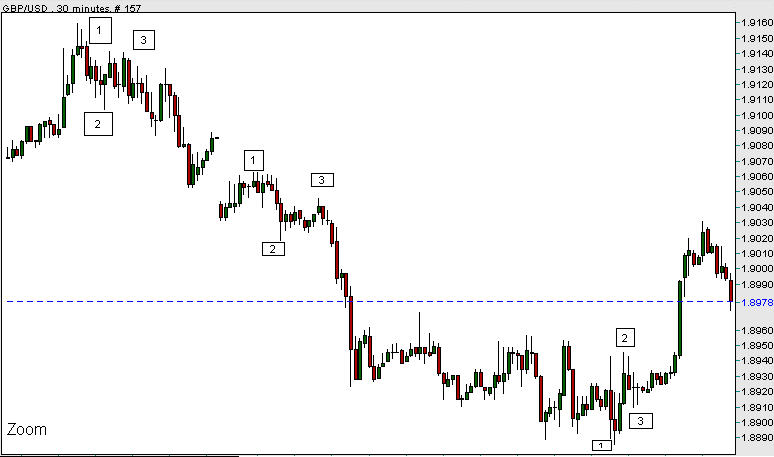

| Trading the 123 method alone without visual aids like

the Bollinger Bands is like

navigating the terrain with a compass but without a

map coordinates:

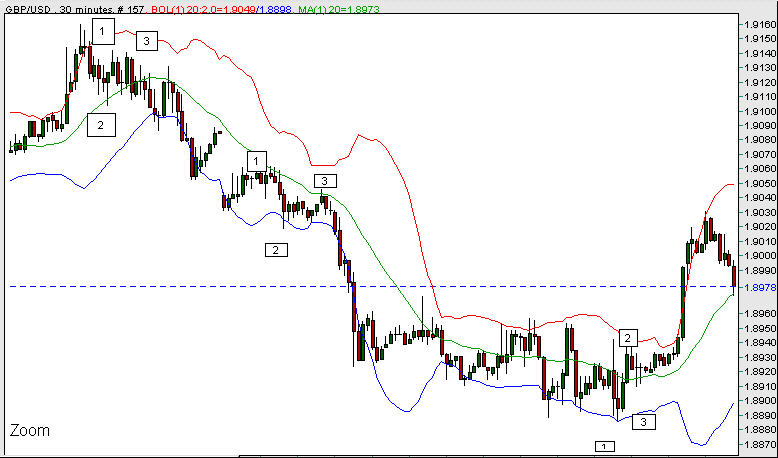

Trading the 123 method with an indicator like the Bollinger Bands provide the

traders, a clearer picture of where the prices were

and where it is heading:

|

| Using the Bollinger Bands as a guide, it is relatively easy to program an

EA to automate (from left

to right) Reversal, Trend and Breakout trades. |

| Prices tend to either bounce back or breakout at the Bollinger Bands

or the Support and Resistance levels.

By applying the Elliott wave principle with the bands

or levels, the traders

can trade with greater confidence based on high probability price patterns. |

| It's a well known fact that price moves in a wave manner, a.k.a. Elliott

Wave.

The difficulty faced by most traders is knowing where the wave is heading

next.

Having an indicator like the Bollinger Bands superimposed in the price chart

and by studying their relative positions and price action can provide the

traders with an excellent perspective of the price movements. |

| Bollinger Bands' standard deviations are designed to help determine when a

price move is statistically out of the ordinary.

Besides it's effectiveness as an excellent indicator for trade setup, the

automated trader can make better use of the bands dynamically as stop losses

and take profits to improve his chances and quantum of winnings. |

| Some traders use the Bollinger Bands as a method to produce buy and sell

signals, while others prefer to use the Bands to find trends, changes in

market direction, and to show the underlying trend in each market move.

The application of another indicator with the

Bollinger Bands will do well as a confirmation of the price movement. |

|

Trading without a stop loss is

like driving without a seat belt. A stop loss like a fastened seat belt can

limit the damages when a crash occurs.

While it isn't difficult to preset stop losses in our trades, so are the stops

hunting.

Having our stop losses programmed in a trading robot and hidden from the

brokers is a better way to stress free trading. |

|

All things said, should you

avoid setting a stop loss for your Forex trade? The answer has to be an

emphatic "NO"! It is dangerous and can potentially

cause severe damage to your account and your psyche. Yes, it is quite human to

sit on losses (and be praying real hard), but as a serious Forex trader, one

of your primary objectives must be to preserve trading capital to fight the

markets another day. |

|

A major cause of failure in

trading is letting your emotions dictate your actions.

Emotional trading will cloud your thinking and disrupt your trading plan.

The surest way to eliminate the greed of winning and the fear of losing is to

automate your trading processes.

Trading robots are 100% emotionless as long as we allow them to do what

they were programmed to do.

We should try not to interfere with the processes of trading robots with our

emotions unless we are convinced that they are no longer profitable. |

|

95% of traders who do not have or do not trade with a plan

lose money in Forex trading.

The trader who has a profitable trading

plan and follows the rules completely will end up as a winner.

The problem is that very few traders who trade manually can adhere to all

their rules all the time to become profitable.

It is said that "Rules that you can't or won't follow will not do you any

good".

This is the major issue with manual trading and this is the reason why I am an

advocate for automated trading. |

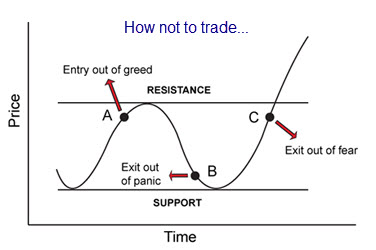

How not to trade Forex?

The Forex market is not random but only appears to be

so.

The result is due to traders making wrong trading

decisions more often than the correct ones.

While trades can be opened and closed at any point in time, many traders choose

to open and close their trades based on their fear or greed at the support and

resistance levels.

A good understanding of the price actions at these levels can provide the astute

traders, the edge to trade the market with the proper timing and the correct

direction.

The reason why technical analysis seems to work remarkably well has to do

with the self-fulfilling prophecy.

A good example is the concepts of support/resistance and the Fibonacci levels.

Because these levels are well-known, they are been watched and acted upon by a

critical mass of traders causing the forecast to become true due to their

combined actions in one way or another.

One of the common mistakes traders made is to enter and exit a trade too

impatiently.

You can make a positive difference to your trading results if you would just let

the prices come to you and not chase after them.

In Summary, the correct way to trade Forex

is to:

-

Make your trading rules as simple as

possible. Don't use anything (indicators and EAs) that you don't understand.

-

Never chase after the prices. Let the price

comes to you before you enter and exit a trade that is deemed to be in your favor.

-

Never trade without a Stop Loss. Always cut

your losses short and let your profits run in your exit rules.

With a trading strategy that incorporates a

high reward to risk ratio exit plan, you can still be profitable even if you

have more losing trades than the winning ones when the small losses are more

than covered by your bigger winnings.

Your trading profit can be dramatically improved with a high probability

trade entry setup and trigger, proper money management and a sound exit plan.

Common Secret

Trade for a Living?

Is Trading Gambling?