Range and

Trend Trading

This is a typical picture of a frustrated trader... his trade

gets stopped out before it turns around to produce a profit.

There are many reasons why a good trade turns bad. Chief among the reasons is

Impatience.

A good trade setup doesn't guarantee a profitable trade outcome.

It has to begin with a desirable price entry and followed by effective closings that

minimize the chances of a loss and maximize the profit potentials.

Most manual traders are prone to impatience for actions

that result in poor trade entries

and premature exits.

The best way to prevent a good trade from

turning bad is to automate your trading.

You will no longer have the urge nor the chance to trade indiscriminately.

Why just trend trade when you can also

trade the ranges?

Please visit

http://www.facebook.com/video/video.php?v=10150161603809501

if you have problem viewing the video here.

Risking only 0.05 lots per trade, one

of my EAs makes $400 with just 8 trades from 1 Jan to

17 April 11 trading on EURUSD Daily in the Fxprimus' Strategy Tester.

This $400 profit is the equivalent of a gain of 800 Pips ($400/$10 a Pip/0.05

lots per trade).

This video proves that there is no

need to lose more often albeit smaller amounts to win

big in trend trading.

Turtles and

Turtle Soup

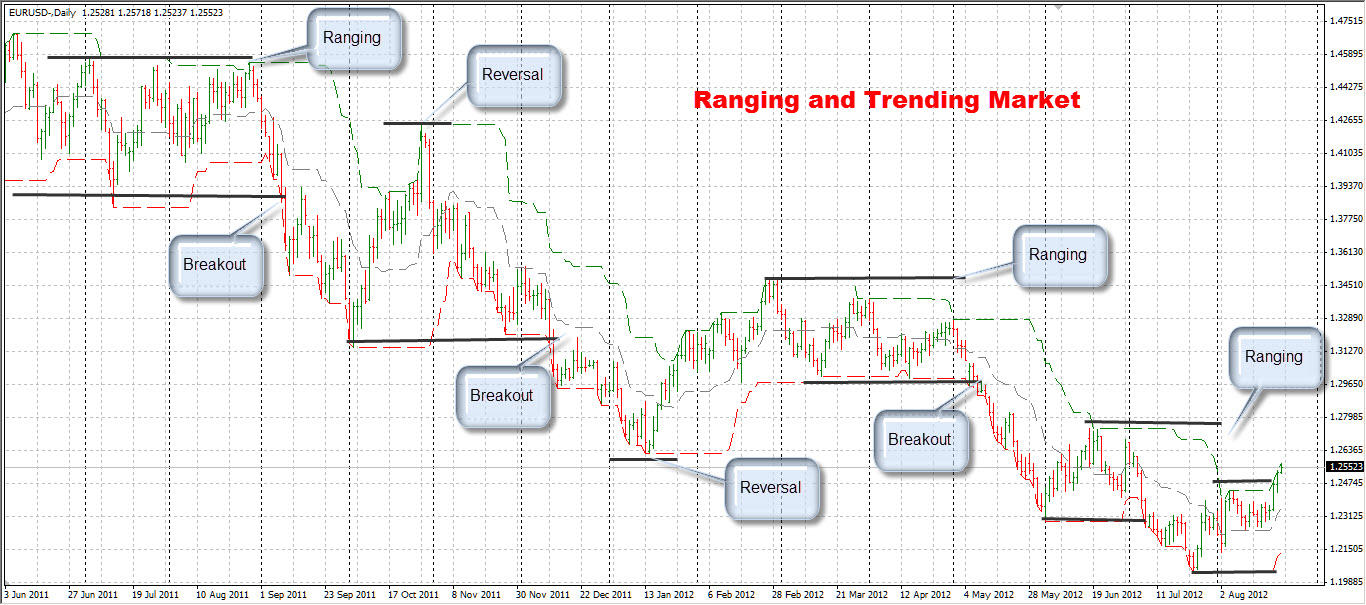

While trading on breakouts like the Turtles offers the

traders the opportunities to huge profits by riding the trend, the problem is

that the market ranges more often than it trends!

It also takes a lot of nerve for a

trend trader to want to continue to ride the wave with huge stop losses and not

knowing for sure when the trend ceases.

As can be seen from

the chart, prices tend to bounce off between the support and resistance levels.

Since the market ranges 70% of the

time, this implies that the Turtles' trades are being stopped

out i.e. become Turtle Soups, 7 out of 10 times!

Therefore, it

makes sense to trade the ranges by Buying at the Bottom and Selling at the Top,

and letting the profits run when the market decides to trend at price breakouts.

Trading the ranges

can also catch the very start of a new trend when the market reverses by letting

your remaining lots ride the wave up or down.

It is also

statistically favorable to trade the ranges than the trends!

What is a sound trading plan?

My definition of a sound trading plan is a system that can adapt automatically

to changing market conditions.

Since the market condition is either ranging or trending, the range or trend

traders will be in trouble when the market condition persists and is not in

their favor.

To profit consistently, our trading system must be able to identify and react

correctly to changing market conditions.

A potential change in market condition usually occurs at or near

support and resistance levels.

Reacting correctly to price patterns at these action areas will provide us with

an edge in our trade entries and exits.

More importantly, we must prioritize the conservation of our capital

over the potentials of our trading profits to stay afloat in

trading.

If we can lose little and win big consistently in our

trading, we cannot fail but to profit from the market, in the long run.

Automated

Trading

Although it is possible to

stay around to manual trade

successfully with high probability trade entries, it can be tedious and

stressful to manage the trade efficiently and effectively thereafter...

An EA or trading robots can be programmed to automatically: